Menu

Copyright 2023 © All Rights Reserved – Privacy Policy

Used interchangeably with petroleum diesel, in contrast with biodiesel, which is mixed with conventional fuels

Results in a reduction of CI of ~65% versus conventional diesel

Made by hydroprocessing of natural fats and oils, to be chemically the same as petroleum diesel

Can be produced through waste oils and fats, solid waste and non-food crops, or synthesized via direct carbon capture

Critical component of the aviation industry’s sustainability targets, resulting in an 80% reduction in CI vs conventional jet fuels

Now used by over 50 airlines, with >$17bn of forward purchase agreements as of 2022

Used interchangeably with petroleum diesel, in contrast with biodiesel, which is mixed with conventional fuels

Can be produced through waste oils and fats, solid waste and non-food crops, or synthesized via direct carbon capture

Results in a reduction of CI of ~65% versus conventional diesel

Critical component of the aviation industry’s sustainability targets, resulting in an 80% reduction in CI vs conventional jet fuels

Made by hydroprocessing of natural fats and oils, to be chemically the same as petroleum diesel

Now used by over 50 airlines, with >$17bn of forward purchase agreements as of 2022

Richness of individual revenue streams and capture of opex margins creates highly robust economics even at extreme downside cases – project remains EBITDA positive from just one output stream, without tax credits. Downside is therefore highly limited, with asymmetric capacity for accretion

Renewable fuel ESG credentials are compounded by the production process to create outsized green credentials. Circular economic model utilizes all by-products, resulting in a zero-waste ecosystem with minimal environmental footprint

Differentiated margin capture and outsized yield is further enhanced by extremely favorable economics of the Inflation Reduction Act, providing both Investment and Production Tax Credits to enhance project cashflows over the initial terms of the credit mechanisms

Revenues span commodities, regulatory credits, and associated tax credits, with the further ability to monetize final byproducts to create a truly zero-waste ecosystem monetizing all output. Range of revenue streams enhance incremental returns from all avenues, as well as providing inherent diversification and hedging capabilities

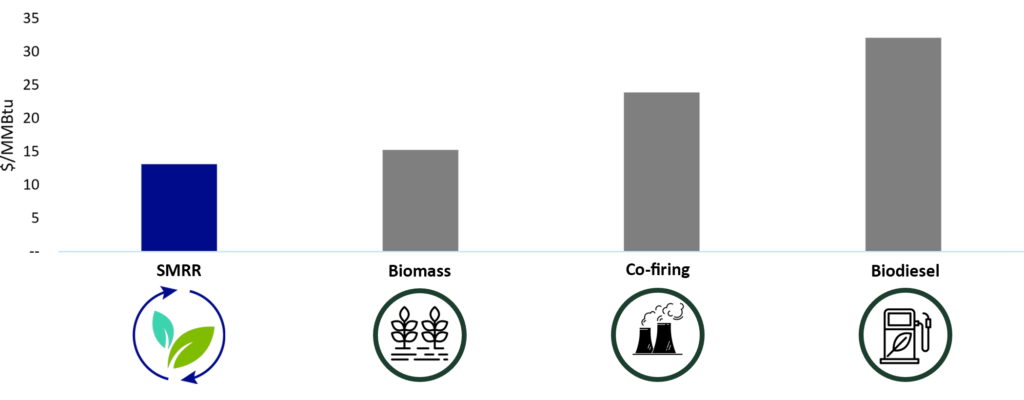

Integrated, circular model internalizes substantially all feedstock and operating costs, capturing all leakages within the ecosystem, driving significant margin expansion, and making SMRR the lowest LCOE producer of renewable fuels. Lowest cost position optimizes position on the merit curve, and further catalyzes the project’s margin capture on merchant revenue streams

SMRR eliminates the two biggest risks in the renewable fuels industry: lack of feedstock availability and flexibility, by utilizing an offtake strategy as well as a unique, circular business model. SMRR can maximize asset functionality and mitigate price shocks through its feedstock flexibility. Due to the project’s vertically integrated nature, Santa Maria can absorb input price shocks, capitalize on market volatility, and generate strong cash flows

Copyright 2023 © All Rights Reserved – Privacy Policy